Elder Fraud Sweep Nets 250 Defendants, $500M in Losses

The Justice Department recently unveiled the largest ever coordinated investigation of elder fraud cases. In total, more than 250 defendants have been charged in schemes involving over one million senior victims and half a billion dollars in losses.

Victims may need to file civil charges in order to recover stolen funds.

Charges have been filed against the defendants in dozens of federal districts, including the three districts in Florida, which has the highest 65 and older population in the country and is experiencing epidemic proportions of elder abuse.

Florida statutes have strong protections for victims of elder fraud. While Justice Department cases may result in criminal punishment for fraudsters, victims may need to file civil charges in order to recover what was stolen from them.

The Business Trial Group handles elder financial exploitation cases on a contingency-fee basis. If you or a loved one was the victim of elder fraud, contact the Business Trial Group for a free case review.

AG Sessions Announces “Unprecedented, Coordinated Action”

Elder fraud costs senior Americans an estimated $30 billion per year. The problem is expected to worsen in coming years as the 65-and-older population continues to grow and technology increases access to victims. Aging Baby Boomers—the richest generation in U.S. history—make particularly lucrative targets for fraudsters.

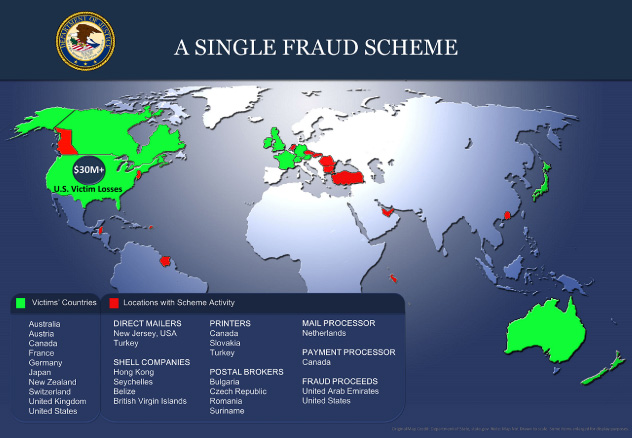

The DOJ’s sweep targeted fraudsters from around the globe and demonstrates how fraud schemes can be transnational. One scheme involved victims in wealthy industrialized nations and scheme activity in North America, Asia, Europe, the Middle East, and Latin America.

“The Justice Department and its partners are taking unprecedented, coordinated action to protect elderly Americans from financial threats, both foreign and domestic,” said Attorney General Jeff Sessions in a press statement. “I have directed Department prosecutors to coordinate with both domestic law enforcement partners and foreign counterparts to stop these criminals from exploiting our seniors.”

State attorneys general, the U.S. Postal Inspection Service, the FBI, and the Federal Trade Commission coordinated with the DOJ in the law enforcement effort.

Types of Scams

Prosecutions in the DOJ’s investigation reveal a range of fraud schemes, including:

- Mass-mailing fraud: Fraudsters direct-mail letters falsely promising cash or prizes in exchange for victims sending payment for purported processing fees or taxes.

- Lottery phone scams: Fraudsters call seniors and tell them that they will receive lottery winnings after paying a large fee or taxes.

- Grandparent scams: Scammers convince seniors that their grandchildren have been arrested and need bail money.

- Romance scams: Victims are led to believe that that an online love interest needs funds to visit the U.S., or for some other purpose.

- IRS imposter schemes: Scammers pose as IRS agents and tells victims they owe back taxes.

- Guardianship schemes: Relatives or guardians steal resources from seniors.

While there are many types of elder fraud schemes, the common element is a duplicitous relative, guardian, or stranger who gains—and then betrays—a senior’s trust. Average losses total about $11,500, according to a report from True Link Financial, but some seniors end up losing their entire life savings to fraud.

Florida Elder Fraud

An elderly man in Bradenton, Florida lost his life savings to a financial adviser who promised to invest the senior’s money, but instead drained $96,000 from his bank accounts.

The victim thought he could trust the adviser because he was churchgoing and respected in the community. But unfortunately, persons in a position of trust—such as financial advisers, caretakers, family members, and priests—commit 90 percent of elder abuse.

Florida has one of the highest number of fraud filings in the DOJ’s sweep.

Senior financial abuse is a serious problem in Florida, where more than 19% of state residents are 65 and older. Three of the five U.S. counties with the largest percentage of residents aged 65+ are in Florida. Florida’s elder population is expected to double by 2030.

Not surprisingly, Florida has one of the highest number of fraud filings in the DOJ’s investigation. The majority of the filings are in the Southern District of Florida.

In one scheme against Florida residents, the fraudsters allegedly targeted users of internet dating and social networking sites to feign romantic relationships with the users and then created fictitious scenarios in which the users needed to wire funds to the fraudsters in order to advance the relationships. Other schemes that targeted Floridians allegedly involved lottery scams, fraudulent tax returns filed with personal information stolen from nursing home residents, and unauthorized credit card accounts opened in a senior’s name.

Contingency-Fee Florida Elder Fraud Lawyers

Florida’s Elder Exploitation statute allows senior fraud victims to file a civil lawsuit to recover damages, punitive damages, and attorneys’ fees and costs.

The Business Trial Group represents victims of financial exploitation on a contingency-fee basis. Our clients pay no up-front fees, and no fees at all unless we recover money for them.

Learn more about how we help elder fraud victims during a no cost and no obligation case review.

Recent news