Rockledge Priest Fraud Case Highlights Financial Exploitation of Elderly

A priest from St. Mary’s Catholic Church in Rockledge was arrested in September for allegedly stealing nearly $90,000 from an elderly widowed parishioner.

The case exemplifies a growing problem in Florida and nationwide: financial exploitation of elders by those in relationships of trust.

Father Nicholas King, pastor to St. Mary’s Parish since 1993, “intentionally deprived the victim, a 79-year widow, of the use and benefit of $88,700,” according to the Rockledge Police Department.

Court records show the widow had a money market trust account at Region’s Bank that her late husband established to support the church. King reportedly arranged with the victim to be given pre-signed blank checks drawn from the account. But instead of the money going to the church, King deposited the money into his own private account and spent it on expensive dinners, gourmet chocolate, and a new car.

Were you or a loved one the victim of financial exploitation? Receive a free case review.

The church, meanwhile, was out of money and unable to support wages at its Catholic school, police said.

When her bank account became overdrawn in July the victim alerted church officials, who then went to police. King was charged with grand theft and fraud following an investigation.

Elder Abuse on the Rise

Incidences of elder abuse, neglect, and exploitation are increasing in Florida as the state’s elderly population grows. Verified cases of elder abuse or neglect in Florida nearly doubled from 1,448 in 2011 to 2,525 in 2015.

The true scale of elder maltreatment is difficult to assess, however, due to underreporting. Experts estimate that for every one case reported as many as 25 go unreported.

Elder maltreatment includes physical, emotional, and sexual abuse, neglect, and financial exploitation. Elders are less likely to report financial exploitation than any other abuse category, according to a report from the American Bankers Association.

Older adults attract con artists because they have relatively large savings, tend to be more trusting, and can be vulnerable due to loneliness, depression, or cognitive or physical decline.

Edith Lederberg of the Aging and Disability Resource Center of Broward County says seniors keep quiet about financial victimization because they’re afraid relatives might think they can’t handle their finances.

Elders may also not report financial exploitation out of shame, embarrassment, intimidation by the abuser, or unawareness of the fraud. And since financial abuse is often perpetrated by a trusted confidant, caregiver, or family member, seniors might keep silent about the exploitation to avoid being abandoned or creating family strife.

Data from the Florida Department of Children and Families shows that in 2012 in Florida, there were 6,026 reported cases of financial abuse crimes committed by a person known to the senior—down from 7,395 cases reported to authorities in 2005. But in addition to only including reported cases, these figures do not take into account other financial schemes that target seniors, such as investment fraud and telephone scams.

It’s important to distinguish between financial fraud against elders committed by strangers and financial exploitation of elders committed by those in a position of trust. Methods of the latter include the perpetrator exploiting the victim’s confidence in order to:

- Take money, property, or valuables

- Borrow money and not pay it back

- Sign or cash pension or social security checks without permission, or for unauthorized uses

- Misuse (or use without permission) ATM, credit cards, or bank accounts

- Abuse legal arrangements such as power of attorney, living trusts, and wills

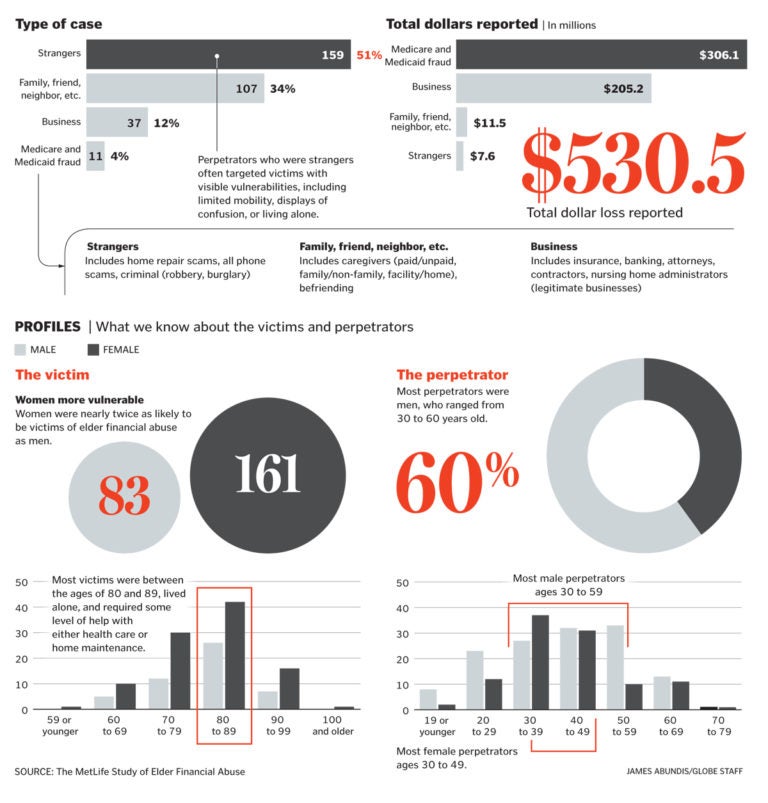

To examine the impact of elder financial abuse on the lives of seniors nationwide, the MetLife Mature Market Institute reviewed relevant news articles and scholarly literature, first in 2008 and again in 2010. MetLife estimated that the annual financial loss of elder financial abuse was at least $2.9 billion in 2010—a 12% increase from the $2.6 billion estimated in 2008.

Other key findings of the 2010 study were:

- 34% of elder financial abuse was perpetrated by family, friends, and neighbors

- Women were almost twice as likely as men to be victims of elder financial abuse

- Most victims were between the ages of 80-89, lived alone, and required some type of health care or home maintenance assistance

- Nearly 60% of perpetrators were males between the ages of 30 and 59

Source: Boston Globe

Elder abuse of all types will likely continue to increase in coming years as America’s population ages. The number of U.S. persons 60 years or older is expected to surpass 92 million by 2030—up from 57 million in 2010.

With more than 4.9 million residents age 60 and older, Florida leads the nation in percentage of citizens who are elders. Florida’s senior population is expected to reach 7.1 million by 2030.

“With so many older adults living in your state, Florida is like a laboratory for all kinds of scams,” Sandra Timmerman, director of the MetLife Mature Market Institute, told the Miami Herald. “It’s a fertile market.”

Florida Elder Protection Law

Florida law provides strong legal protections for financially exploited elders.

Under Florida’s Elder Exploitation statute, a vulnerable adult—defined as anyone over the age of 18 who cannot provide for his or her own care or protection due to a physical, mental, or emotional impairment, or due to the “infirmities of aging”—can file a civil lawsuit to recover damages (including punitive damages) as well as attorney fees and costs if they are financially exploited.

Florida statute defines “exploitation” broadly. It covers anyone who “stands in a position of trust and confidence with a vulnerable adult” and knowingly, through deception or intimidation, permanently deprives (or attempts to deprive) the vulnerable adult of funds, assets, or property.

Florida also requires anyone with knowledge of vulnerable adult exploitation to report the case. Failure to report is considered a second degree misdemeanor. The Florida Department of Children and Families recommends that reports be made to the Florida Abuse Hotline (1-800-96-ABUSE).

Justice for Exploited Elders

In addition to reporting elder financial exploitation to state authorities, you may wish to get in touch with Morgan & Morgan’s Business Trial Group to discuss a possible legal claim.

The Business Trial Group handles cases on a contingency-fee basis, meaning you pay for results, not hours. Whether it’s a trust or estate dispute, investment fraud, or a financial dispute with a home health agency or nursing home, the Business Trial Group is uniquely positioned to fight for our clients. With the resources and experience of a 300+ attorney law firm, we are able to go toe-to-toe with the largest opponents and achieve justice for our clients, whether through settlement or trial.

To learn more, please submit a no-cost, no-obligation case review form.

Recent news